Monday Report

- August 15, 2022

- | Market Insights, Monday Report

- 6 min read

- You can also download this report in

Economy

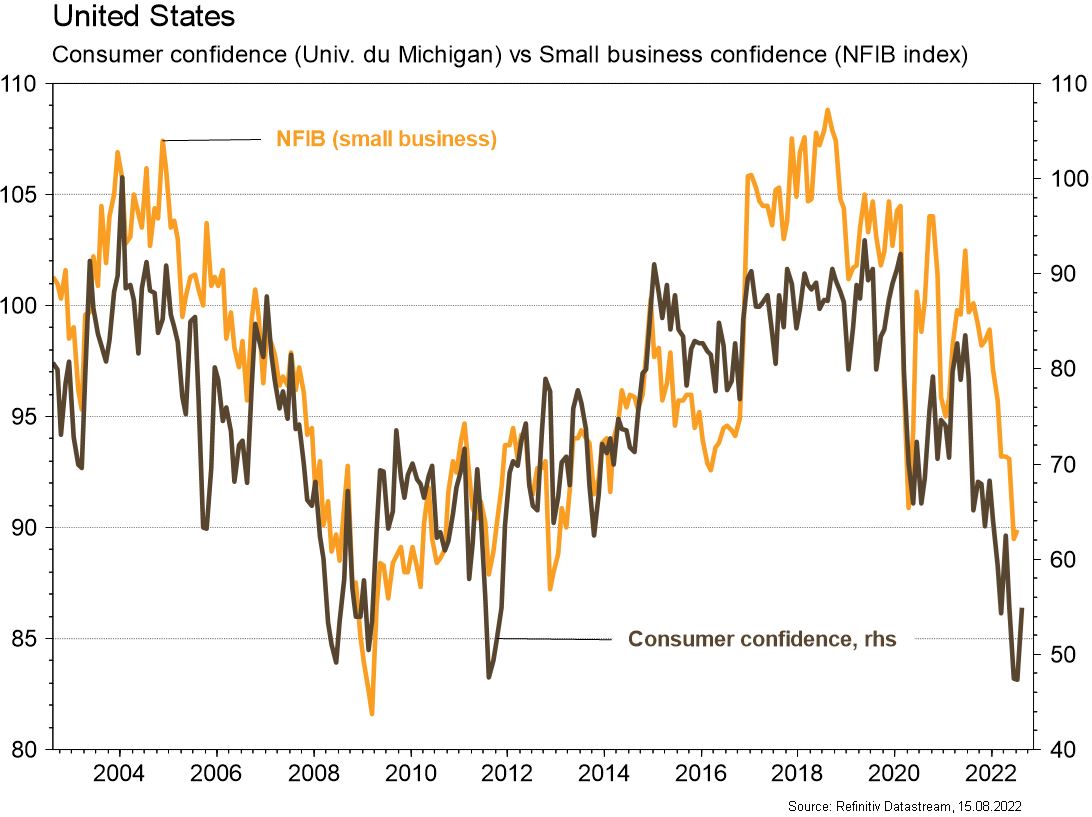

Last week’s US statistics were fairly reassuring. SME confidence (NFIB index) stabilised in July (at 89.9, vs. 85.5 the previous month), while consumer confidence (Univ. of Michigan) picked up from 51.5 to 55.1. Furthermore, consumer price inflation began to slow year on year, falling from 9.1% to 8.5%. Excluding energy, inflation was stable at 5.9%, well above the Fed’s target but lower than expected. In the eurozone, the Sentix indicator of investor confidence picked up slightly in August (from -26.4 to -25.2), while June industrial production surprised to the upside (up 0.7% MoM and 2.4% YoY). In China, with inflation still under control (at 2.7% YoY) and recent economic activity disappointing (industrial production: up 3.7% YoY; retail sales: up 2.7% YoY; investment: up 5.7% YoY), the PBoC was able to cut interest rates by 10 bps.

Climate

The US House of Representatives passed Joe Biden’s Inflation Reduction Act, already passed by the Senate, approving c. $370bn of Transition spending. According to initial estimates, this should shorten the timeline for cutting US emissions, bringing them down by between 31% and 44% by 2030 relative to a 2005 baseline (still not enough to meet commitments under the Paris Agreement).

Markets

Good news on inflation fuelled risk appetite. Equities gained ground (up 3.3% in the US, 1.2% in Europe and 1.4% in emerging markets), credit spreads narrowed and commodity prices rose (with oil up 3.5%, copper 2.8% and gold 1.1%), buoyed by the falling dollar (with the dollar index down 0.9%). Ten-year yields climbed a few basis points higher in the eurozone and held steady in the US. To be monitored this week: Empire Manufacturing, Philadelphia Fed leading indicator, confidence among homebuilders, housing starts, building permits, industrial production, retail sales and Fed minutes in the US; and ZEW confidence indicator, trade balance and second read of Q2 GDP in the eurozone.

Swiss Market

To be monitored this week: FSO July PPI, FSO Q2 property price index, FOCBS foreign trade/watch exports, FSO Q2 employment statistics and FSO Q2 industrial production. The following companies are due to report results: Orior, Straumann, Huber+Suhner, Basilea, Orascom DH, Schweiter, Tecan, Gurit, Implenia, Komax, Swiss Life, BCV, Meyer Burger, Emmi, Geberit, Zur Rose, PSP Swiss Property and u-blox.

Equities

DEUTSCHE TELEKOM (Satellites) has slightly upgraded its forecasts for the US and Europe. The group is now targeting adjusted EBITDA of €37bn and FCF of over €10bn (assuming constant EUR/USD exchange rates). In addition, DT is set to become majority owner of T-Mobile well before 2024 (it currently owns 48.5% but could increase its holding to over 50% if Softbank exercises its call option).

DISNEY (Core Holdings) has downgraded its target for streaming subscribers (Disney+ and Hotstar) from 230-260m to 215-245m. However, management is looking to make this segment profitable by the end of fiscal 2024 by adding new content and raising subscription prices. Its profitability target remains highly ambitious given high production costs and the fact that some regions (Asia in particular) will continue to run at a loss.

MONDI PLC (Satellites) has entered into an agreement to sell its Russian site, the value of which the market had stripped out of the share price, for €1.76bn, which equates to £3.06 per share. The share closed 11% higher after the announcement on Friday (up £1.70). The deal still has to be approved by Russia’s antitrust authority and Commission for the Control of Foreign Investments.

Bonds

In the US, July inflation came in lower than expected (at 0%, vs. 0.2%), mainly driven by the energy component (down 42 bps). Some Fed members said this slowdown did nothing to change the monetary policy trajectory, with 12-month rolling inflation still very high (at 8.5%). As regards yields, the US curve ended the week more or less unchanged after initially beginning to steepen. In credit, HY spreads narrowed in both the US and Europe (down 20 bps and 30 bps respectively) and have now retraced 65% and 45% respectively of their year-to-date widening.

Sentiment of traders

Stock market

Last week was another week of gains thanks to the weaker than expected US CPI read, with US indices having now retraced half their losses. This week will be dominated by US consumption, with Walmart and Home Depot both set to report their results and, on the macro front, retail sales due out. In Europe, the ZEW indicator, trade balance and GDP (second read) will also come under close scrutiny.

Currencies

After undergoing a rapid correction on the back of US CPI numbers, USD regained a bit of its lost ground, rising to EUR/USD 1.0234. We anticipate a range of EUR/USD 1.0050-1.0370. Fears of recession in Europe and the UK have pushed EUR and GBP right down against CHF: EUR/CHF 0.9650; GBP/CHF 1.1415. Our ranges – USD/CHF: 0.9370-0.9740; EUR/CHF: 0.96-0.9805 ; GBP/USD: 1.1890-1.2330; XAU/USD 1,711-1,815.

Today’s graph

Performances

This document has been issued for information purposes and is exclusively supplied by Bordier & Cie SCmA in the framework of an existing contractual relationship with the recipient of this document. The views and opinions contained in it are those of Bordier & Cie SCmA. Its contents may not be reproduced or redistributed by unauthorized persons. The user will be held liable for any unauthorized reproduction or circulation of this document, which may give rise to legal proceedings. All the information contained in it is provided for information only and should in no way be taken as investment, legal or tax advice provided to third parties. Furthermore, it is emphasized that the provisions of our legal information page are fully applicable to this document and namely provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier Bank does namely not provide any investment services or advice to “US persons” as defined by the Securities and Exchange Commission rules. Furthermore, the information on our website – including the present document – is by no mean directed to such persons or entities.

"*" indicates required fields

insights

- Switzerland

- 22/08/2022

Read the latest weekly report on the financial sectors and financial …